When we talk about digital security for non-profits, the focus is rightly on prevention: strong passwords, multi-factor authentication, secure data handling for donor and beneficiary information, regular backups, and training staff and volunteers to spot threats. These practices are essential pillars of responsible stewardship. However, they don’t guarantee complete protection.

No organization, no matter how mission-driven or careful, is immune to cyberattacks. Even the most security-conscious non-profits can become victims. A single volunteer clicking a convincing phishing email, a momentary lapse by busy staff, or an unknown software vulnerability can lead to devastating consequences – compromising sensitive data, disrupting vital services, and eroding hard-won donor trust.

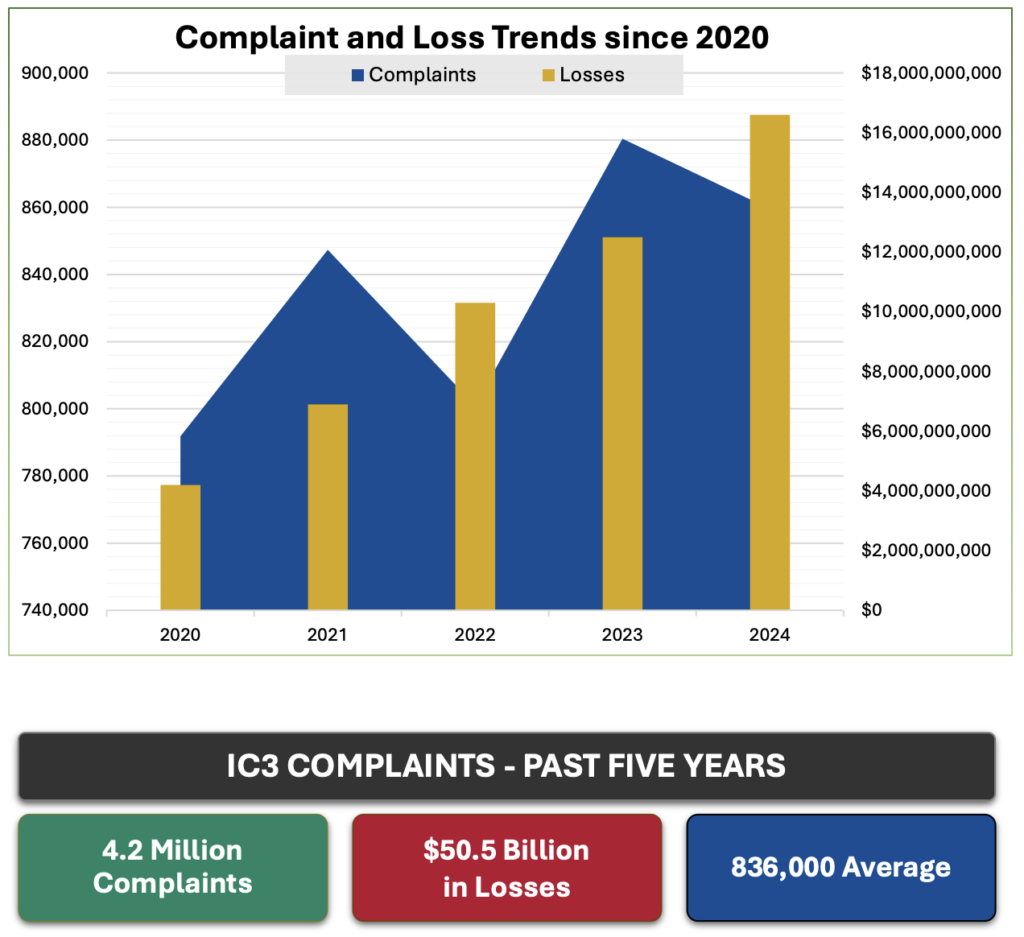

The FBI’s Internet Crime Complaint Center (IC3) paints a stark picture, estimating $50.5 billion in cybercrime losses between 2020 and 2024. Non-profits, sometimes perceived as having fewer resources for defense, are increasingly targets.

Given that perfect security is unattainable, protecting your organization from the potentially crippling financial fallout is crucial. Just as liability insurance is necessary for events, the rising tide of digital threats makes cyber insurance an important consideration for non-profits dedicated to protecting their mission and stakeholders.

What Is Cyber Insurance for Non-Profits?

Cyber insurance helps non-profits recover financially and operationally after security breaches or online attacks. Unlike standard liability policies, it specifically addresses the risks tied to using technology to deliver services, manage operations, and store sensitive donor, beneficiary, volunteer, and employee data.

While non-profits of all sizes are vulnerable, small and medium-sized organizations often face heightened risk due to limited IT budgets and staff. If your non-profit collects personal information, processes online donations, stores confidential case notes, or relies heavily on digital communication, the need is even more acute. Realistically, any NPO using email or online banking faces potential threats.

What Does It Typically Cover?

A non-profit cyber policy usually includes two main coverage types:

- First-party coverage: Addresses direct costs incurred by your organization, such as:

- Legal expenses related to the incident.

- Costs for data breach response, including forensic investigation and notifying affected donors, beneficiaries, or employees.

- Expenses related to ransomware demands and recovery.

- Losses from service interruption impacting your ability to serve beneficiaries.

- Data restoration and system repair/replacement costs.

- Crisis management and reputation repair expenses (vital for maintaining donor confidence).

- Third-party coverage: Protects your NPO against claims from others affected by a breach originating from your systems, including:

- Legal defense costs against lawsuits.

- Settlements or judgments.

- Regulatory fines and penalties (e.g., under CCPA for mishandling Californian's data, or potentially HIPAA if applicable).

- Fines related to payment card processing breaches (PCI-DSS).

What’s Not Covered

It's critical to understand common exclusions:

- Weak Security Practices: Insurance doesn't replace due diligence. If your NPO isn't implementing fundamental security measures (like strong passwords, MFA where possible, security awareness training, patching known vulnerabilities), a claim related to those weaknesses may be denied. Insurers expect responsible stewardship of resources, including basic cybersecurity hygiene, and will likely verify minimum practices are in place.

- Prior Breaches: Events that occurred before the policy started are typically not covered.

- Insider Attacks/Misconduct: Deliberate fraudulent acts by leadership or employees are generally excluded.

Shopping for Cyber Insurance as a Non-Profit

How much does it cost? It varies based on your NPO's size, revenue/budget, the type and volume of sensitive data handled, existing security measures, desired coverage limits, and deductibles. While costs range widely (from under $1,000 annually for very small organizations to many thousands for larger ones), it's crucial to weigh this against the potential cost of an incident.

The average cost of a data breach is staggering (millions globally). While that figure often reflects larger corporations, the impact on a non-profit can be existential, potentially leading to loss of major grants, collapse of donor confidence, and inability to deliver core services. IBM’s 2024 Cost of Data Breach Report found that the average cost of a data breach was $4.9 million globally, but $9.4 million in the United States. Although IBM doesn’t break out costs by company size, those costs are likely for larger companies. Nonetheless, a Financial Times report notes that users at small and medium-sized businesses were twice as likely to encounter threats as those at large companies.

Choosing the right insurance broker is vital. Look for one with experience serving non-profit organizations, who understands NPO-specific risks (like donor data sensitivity and grant compliance implications), has expertise in cybersecurity practices, and can help you navigate the application process. Your IT support provider can be a valuable partner in this search and in ensuring you meet underwriting requirements.

When comparing policies, confirm coverage addresses risks relevant to your NPO's operations and data. Scrutinize exclusions. Research the insurer's reputation for handling claims efficiently – timely support during a crisis is essential. Ask about risk management resources they might offer to help improve your security posture.

Start Researching Cyber Insurance Now

Cyber threats are unfortunately increasing. Proactive security measures are your first and best line of defense, demonstrating responsible stewardship. But a single successful attack can still occur. Cyber insurance provides a critical financial safety net to help your non-profit recover and continue its vital mission if the worst happens.

Finding the right policy takes effort, but the peace of mind is invaluable. We can assist in evaluating your security posture to meet insurance requirements, connecting you with knowledgeable brokers, and ensuring your technology supports, rather than hinders, your mission. Protecting your organization allows you to focus on serving the Los Angeles community.

(Featured image by iStock.com/Who_I_am)